COVID-19 is likely to be one of the worst crises to face our world in generations. It has already taken a colossal toll on human lives and the global economy, and as yet there is no clear end in sight.

While all sectors have had their share of economic distress, tourism has taken the brunt of the damage. Human movement has all but comes to a standstill as countries attempt to stop the spread of the virus. In the short term, global tourist arrivals could decline by 58 to 78 percent, down to their lowest levels after eight years of steady growth. As much as $847–$1,175 billion in international tourism expenditure could be lost.

This impact is particularly significant for the GCC, where tourism has become the backbone of efforts to reduce reliance on oil and develop more diverse economies. Several major events and religious observances have already been affected, and international tourist arrivals could fall anywhere from 34 to 70 percent in each country.

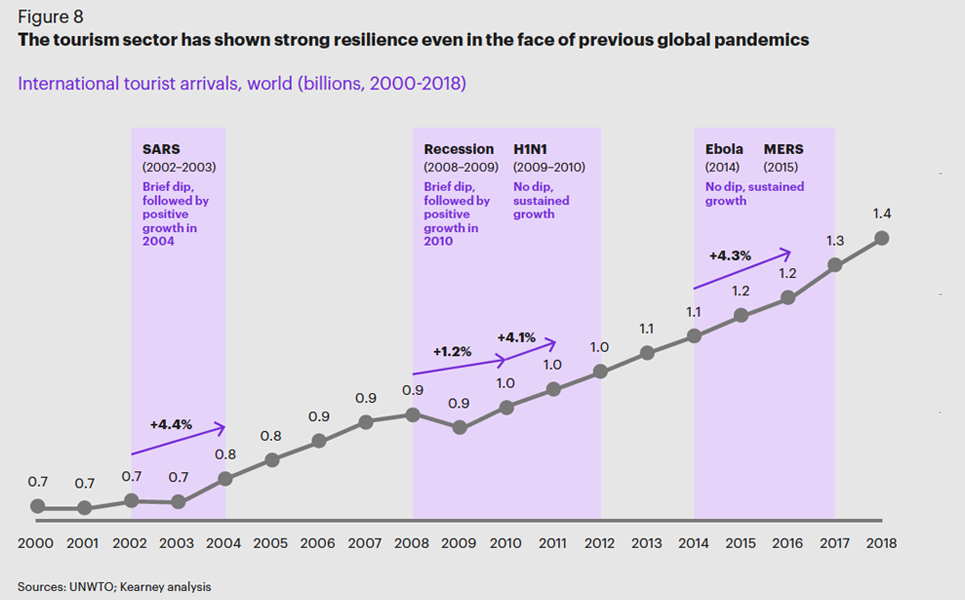

However, despite the large losses that are forecast in the short term, both globally and in the GCC, we predict that recovery in the sector is inevitable— but it will be bumpy. First, tourism is integral to the economic health of all regions: it contributes more than 10 percent of the world’s GDP and accounts for one in 10 jobs. Second, it has also proved resilient in the face of previous economic shocks, such as the 2008 financial crisis and previous outbreaks of infectious diseases such as SARS, Ebola, and MERS.

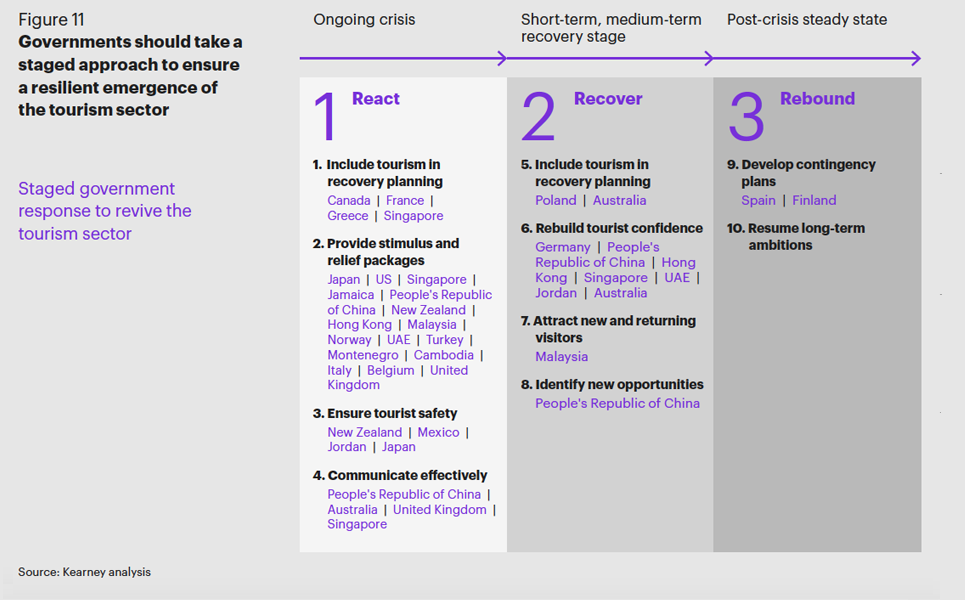

Governments are already taking mitigating action to control the outbreak and assist ailing industries. But to be sure of moving out of the crisis, enabling tourism to recover and regain its resilience, we recommend following a comprehensive 10-step approach:

Stage one: react

- Include tourism in recovery planning

- Provide stimulus and relief packages

- Ensure tourist safety

- Communicate effectively

Stage two: recover

- Recalibrate the plan

- Restore tourist confidence

- Attract new and returning visitors

- Identify new opportunities

Stage three: rebound

- Develop contingency plans

- Resume long-term ambitions

We describe each of the steps, including examples where countries have already taken action, and present our long-term outlook for the tourism sector once the crisis has passed.

A world in crisis

COVID-19 has swept the globe at whirlwind speed, catching nations and governments unaware and leaving them to face the worst world healthcare crisis in generations. With the virus yet to peak in many countries and the number of infections and deaths still rising, there is no clear end in sight.

Unsurprisingly, the economic effect has been severe as countries introduce measures to limit the spread of the virus. The probability of a global recession is becoming more likely by the day with stock markets exhibiting strong volatility, supply chains being disrupted, and the price of oil dropping into the red for the first time in history. The GCC has not been immune from the impact. Here, consumer spending has deteriorated, manufacturing activity has slowed down, and major stock indices are also experiencing volatility.

Tourism bears the brunt

While most sectors have had their share of the shockwave, tourism has taken the brunt of the economic impact so far. For an industry that depends solely on human mobility, and given the pervasive spread of the virus, it’s no surprise that lockdowns and social distancing restrictions have taken an immediate and heavy toll. Being largely discretionary in nature, tourism is also more volatile than many other sectors and has historically suffered more from strategic shocks such as the 2008 financial crisis.

All segments—hotels, airlines, cruises, restaurants, travel agents, and tour operators—have taken a strong hit, and many of the large global events tourism thrives on, such as the Tokyo Olympics and the Cannes Film Festival, are being canceled or postponed.

Within the GCC, tourism has become the backbone of ambitious plans to reduce the region’s historical reliance on oil and develop more diverse economies, meaning the impact of the pandemic is particularly significant (see figure 2). Several major events— including the Bahrain Grand Prix, Art Dubai 2020, and the Dubai Expo 2020—that together would have attracted millions of visitors, have been canceled or postponed. In Saudi Arabia, where the sector is heavily dependent on religious tourism, Umrah visits have been banned, and government officials will make their final decision on this year’s Hajj pilgrimage in early June, which could include a potential delay of the Hajj season, affecting huge numbers of international pilgrimages.

Big losses in the short term

Even using conservative estimates, there’s no doubt that international tourist arrivals—and the associated income from spending and jobs—will suffer in the short term, both globally and across the GCC.

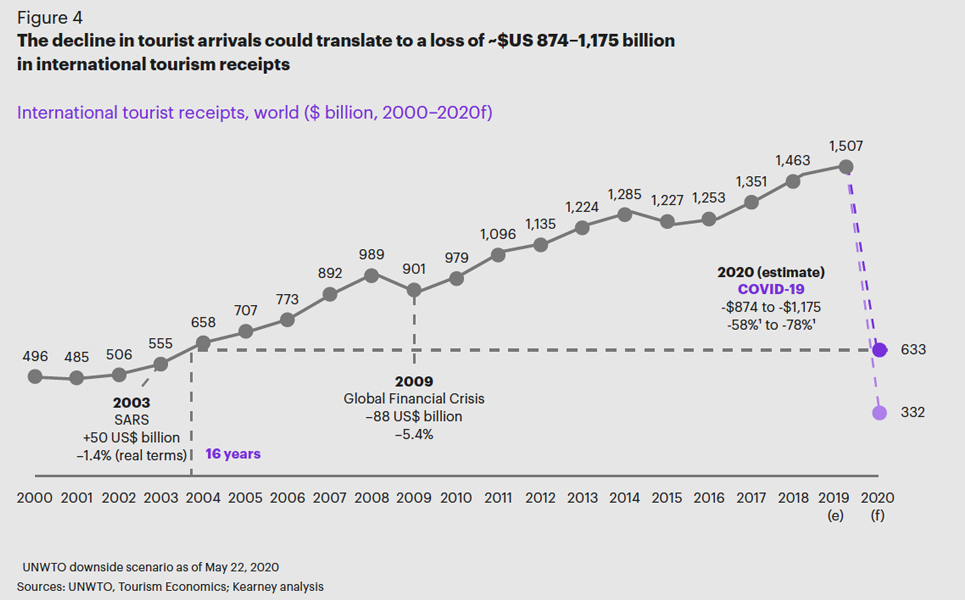

Worldwide, it’s likely that tourist arrivals will drop by between 58 and 78 percent, leaving them at their lowest levels after eight years of steady growth and cutting international tourism receipts by $874–$1,175 billion (see figures 3 and 4). Up to 75 million jobs could be at risk, according to the World Travel & Tourism Council (WTTC), with small- and medium-sized businesses—which make up 80 percent of the sector—most affected.

In the GCC, international tourist arrivals look likely to fall in the millions—by anywhere from 34 to 70 percent in each country—including to the lowest levels in KSA, the UAE, and Qatar in about a decade. Meanwhile, more than $40 billion in international tourism receipts could be lost across the region.

A bumpy but certain recovery

For sure, the road to recovery will not be simple, and the current unfolding of events does not seem encouraging (for example, major airlines going bankrupt, small tourism businesses closing, and discretionary spending decreasing). The industry might need to witness some structural changes in the short and medium terms (for example, renationalization of airlines, incentives to promote travel and tourism, price hikes to recuperate losses) as it moves toward the longer-term stage where demand for travel and tourism returns to normal. Despite this bleak short-term outlook, the long-term recovery is certain, anchored by the vitality of the sector to the global economy and its historic resilience in the face of previous pandemics.

Given the tourism sector’s characteristic vitality, it is integral to the economic health of all regions (see figure 6). Today, it contributes more than 10 percent of the world’s GDP ($8.8 trillion in 2018) and accounts for one in 10 jobs (319 million). It has outpaced the global economy in terms of growth and proved resilient in the face of previous economic shocks (see figure 7 and figure 8). This experience shows us that although the short-term impact of COVID-19 is not to be underestimated, recovery, once the crisis is over, is almost certain.

One major influence is the projected growth of a global middle class. According to the European Commission, this is expected to be in the region of 5.3 billion people by 2030, when middle-class spending will have jumped to $64 trillion, compared with $37 trillion in 2017, accounting for a third of GDP growth.

First steps in the GCC

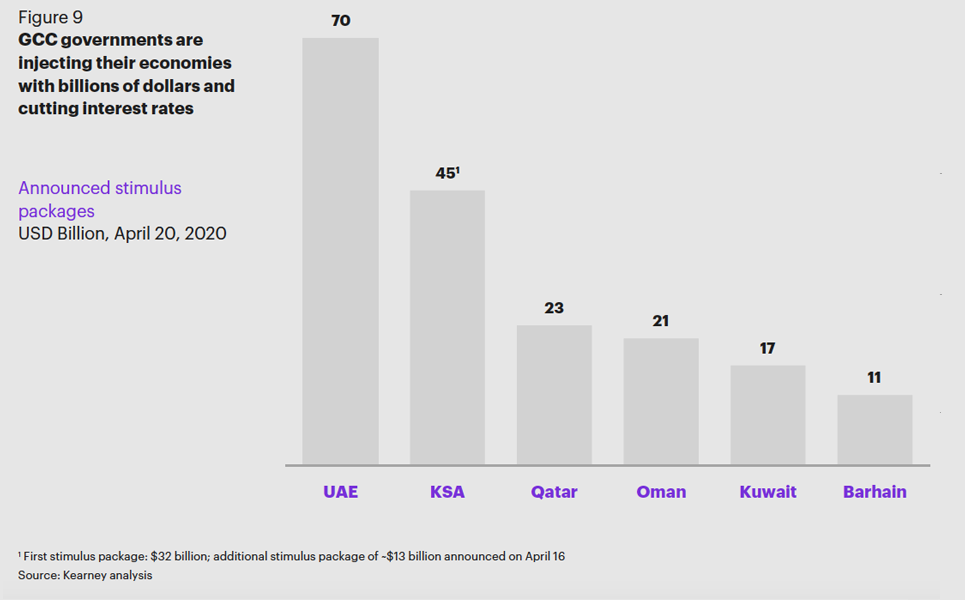

Governments in GCC countries have been quick to protect their populations by imposing travel bans, curfews, and lockdowns, while economic help has included stimulus packages and a cut in interest rates (see figure 9).

The tourism sector is part of emergency response plans, although specific details have yet to be announced publicly (see figure 10).

A guide for government action

Based on our extensive knowledge of the tourism sector, understanding of previous periods of recovery following earlier crises, and an analysis of current efforts around the globe, we suggest the following phased approach for governments as countries continue the battle against COVID-19 (see figure 11).

Stage one: react

While the crisis continues, make sure mitigating steps are in place or in the plan

In Singapore, the Prime Minister is briefing the population directly every couple of weeks, and in the UK, government press conferences have been made available on YouTube as well as its own website to give the latest statistics and measures being taken to mitigate risks.

Dedicated health emergency news sources are also important to keep citizens informed. The Australian Department of Health has created a webpage that gives daily updates on the spread of the virus, as well as details of its Emergency Response Plan and support available for those in immediate need. Singapore has also launched a public awareness campaign, using cartoons to communicate safety procedures to people of all ages, and is giving key updates via WhatsApp.

Stage two: recover

Get the industry back on its feet in the short to medium term

Once ready to reopen to visitors, extra safety protocols will be needed to eliminate any chance of a new outbreak.

Stage three: rebound

Resume long-term ambitions, but prepare for future shocks

Conclusion

While COVID-19 has undoubtedly changed life—and travel habits—beyond all recognition, the current crisis state will be temporary. Even while the battle against the disease goes on, countries and their governing administrations are looking ahead and planning what must be done to restart economies and return society to some semblance of normality.

Tourism is not only a key building block of those economies, it is something that enables us to understand other regions and cultures and is a source of great joy in many people’s lives.

Although the immediate impact on the industry has been bitter, we don’t see radical structural changes being needed unless it falls prey to further unforeseeable shocks in quick succession. What we do expect is that with careful management, and using a staged approach, governments will be able to move their tourism sectors into recovery and that they will eventually rebound. We look forward to playing our part in making it happen.

Authors

Antoine Nasr Partner, Dubai antoine.nasr@kearney.com

Karim Bassil Principal, Dubai karim.bassil@kearney.com

Georges Assy Principal, Dubai georges.assy@kearney.com

Ghida El Hassan Consultant, Dubai ghida.elhassan@kearney.com

As a global consulting partnership in more than 40 countries, our people make us who we are. We’re individuals who take as much joy from those we work with as the work itself. Driven to be the difference between a big idea and making it happen, we help our clients breakthrough.